The Opportunities for Thermoplastic Composites

- 31st May 2019

- Chris Hare

- Reading time: about 9 minutes

Why thermoplastic composites?

The primary driving force behind the emergence of thermoplastic composites into the mainstream is the automotive industry. And the things that drive the automotive industry are weight saving and low cost, so how do thermoplastic composites meet the challenge?

It has been clear for some decades that composites can save weight; witness the massive expansion of composites in the aerospace industry where weight saving has been the goal since people learned to fly. The materials of choice for aircraft are carbon/epoxy thermoset prepregs because of their high performance and their ability to be intelligently layered to provide the maximum load bearing capacity. Cost is not such an issue in the aerospace landscape of extreme safety requirements and very low production volumes of high-value items.

As the car industry fragments and the new electric/hydrogen vehicle manufacturers re-write the blueprint for what a car is, lightweighting is very much on the agenda. It promotes a ‘circle of virtue’ whereby the lighter the vehicle becomes, the less battery power is required, the structure can be reduced and the lighter the vehicle can become. The major manufacturers are being rudely awakened by consumer pressure and legislation to really make big steps in vehicle efficiency and not just tinker with more efficient internal combustion engines.

However, looking to the aerospace industry provides more in the way of inspiration than practical or affordable technology transfer for the automotive players. The aero thermoset composites are not conducive to short cycle times and low-cost components. There are messy chemical reactions to be controlled and harnessed into reliable, consistent production. Aerospace composites are excellent, but not that good for high volume vehicle manufacturing.

Thermoplastic composites have therefore stepped in to fill the void. The complicated chemistry is done at the material manufacturer’s site under controlled conditions leaving the component manufacturer to simply melt or soften the polymer with heat and mould it into shape with pressure. There is a multitude of thermoplastic polymers available, from cheap commodity plastics to high-end specialist materials. There are, naturally, some drawbacks. Firstly the viscosity of thermoplastics is generally much higher than thermosets meaning they don’t always flow through reinforcement textiles very easily or for very long distances. Secondly, compatibility with reinforcement fibres is far from optimised although the conversations we have with fibre suppliers leaves us in no doubt that they are working on optimising the bond interface.

In summary, there are many material options at a variety of price points and the performance is improving rapidly. Add in recycling options, unlimited shelf life and improved impact properties and we have the basic drivers for the widespread adoption of thermoplastic composites. So, what are the options?

The thermoplastic composites options

It could be said that in the world of thermoplastic composites there is almost too much innovation and choice. The array of polymers is huge and the processing options are increasing rapidly.

The one constant is probably the reinforcement fibre. Glass, carbon, basalt, aramid and natural fibres can all be used just as they are in thermosets. As mentioned previously, many are not yet optimised for use with thermoplastics but that is just a matter of time and research. In addition to the ‘normal’ fibres, thermoplastics offer the use of cellulose-based fibres (e.g. wood, bast fibre, nano-cellulose) as short fibre or nano-level reinforcement via compounding technologies unique to thermoplastics. These compounds can be used on their own as moulding precursors or they can be combined with long fibres for reinforcement within a reinforcement. Another option is to use fibres that are also made from thermoplastics. In some cases, the matrix polymer and the reinforcement can be the same family (known as self-reinforced thermoplastics) leading to excellent recycling options.

The range of matrix polymers is truly staggering. Not all are suitable for composite use – some are designed for particular non-reinforced applications. The obvious considerations when choosing a matrix polymer are:

- cost – what cost will the product stand? Many commodity thermoplastics are lower in cost than thermoset polymers,

- performance – what temperature does it have to stand, is UV degradation a factor, does it need to be fire retardant and, of course, is it suitable for the process chosen?

- availability – is it economically available in the form required (pellet, fibre, flake, textile, sheet, liquid) and in the quantities required?

Not only does the matrix polymer type have to be considered but it is very much associated with the preferred manufacturing route, which governs the form it is purchased in. Let’s look at the options for forming thermoplastic composites:

- injection moulding – only short (0.5 to 15 mm) reinforcement fibres can be used, limiting the mechanical properties, but complex mouldings can be made with relatively standard equipment and Long Fibre Thermoplastic (LFT) composites are suitable for structural components,

- compression moulding – this process (alternatively called thermoforming) can be carried out with a variety of precursors such as textiles, pre-consolidated sheets (organo sheets) or dough-like extrudate. The thermoplastic materials can be heated inside the tool or outside the tool and they might be premixed with the fibre or mixed at the point of processing,

- tape placement – continuous tapes are laid in flat or shaped moulds and consolidated in-situ into layers by special robot-mounted heads. This technology is very versatile and can make parts in its own right or parts that reinforce other substrates,

- infusion – a relatively rare process which mimics the thermoset RTM process. Because they are very low viscosity, cyclic resins do allow very large parts to be made but currently have no or limited commercial availability,

- extrusion – limited to the manufacture of continuous profiles. Generally with short fibres and therefore of restricted interest for auto applications,

- pultrusion – products feature continuous reinforcement and are therefore of high performance but fixed profile.

In the last decade thermoplastics have truly forged new ground in developing various hybrid technologies which can gain maximum performance through combining processes:

- over-moulding – a preformed (reinforced) sheet is placed in an injection moulding tool and over-moulded with extra details, giving stiff planar structures with detailed features such as ribs or bosses,

- tape placement – reinforced thermoplastic tapes can be combined with other composites, polymers or metallic structures. The bond interface and coefficients of expansion need to be considered.

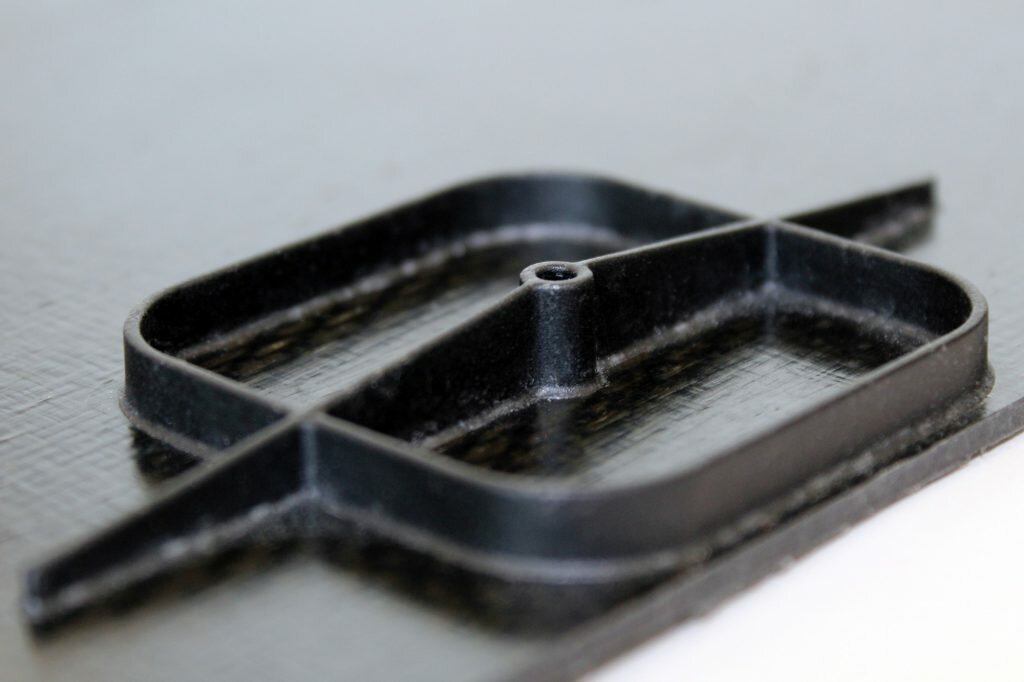

- additive manufacturing – the deposition of thermoplastic polymer can be combined with larger, single thickness mouldings.

The future

We expect to see some competition between the developing thermoplastic composites technologies as they become more refined, lower in cost and as the raw/intermediate materials become more optimised. As with composites in general, the process developers, raw material suppliers and simulation experts will need to continue the education and training of designers and procurement experts to ensure that sensible ‘design for process’ practices are developed. It should be clear that the optimal performance of these new thermoplastic composites will only be achieved by understanding the benefits and drawbacks of each concept and designing to its strengths.

Automation of the forming processes is also a vital factor. Metal forming and joining techniques have been developed over many decades and are highly refined and very efficient. Thermoplastic composites need to rapidly move towards automation and high volume outputs and then go the step further that metals cannot compete with – hybrid mouldings for improved performance and part reduction.

Electric vehicles are likely to be one of the prime drivers behind these developments as much of the traditional thinking needs to be dropped to suit configurations alien to internal combustion engines. Integrated battery trays, cooling ducts, wheel-mounted motors, high-pressure hydrogen tanks and overall light-weighting all require innovative thinking and materials knowledge.

Commercial Opportunities

The market for composites in the automotive sector is already large – $20 billion as of 2016 – and is only going to expand. Here are some of the primary opportunities:

- Simulation – engineers will need to be able to build virtual models of products and predict the properties. Manufacturers will want to simulate tooling and manufacturing processes before committing large sums of money.

- Design – designers who embrace the new thermoplastic composite materials and intelligently design to maximise their effectiveness will be a valuable resource.

- Automation – in order to achieve high volumes, automated lines will need to become the norm. Either traditional composites component manufacturers will need to shift from thermosets to thermoplastics or traditional thermoplastic manufacturers will need to shift into composites. It is also likely that a new breed of companies will seize the initiative.

- Raw materials – as thermoplastic composites expand then the demand for specialist polymers and fibres will increase. Compatibilised polymers and fibres are key and are already, in 2019, proving to be a restriction on progress. High-flow and functionalised polymers will be required, as well as bio-versions to meet carbon emission targets.

- Intermediate materials – innovative combinations of polymers and fibres will be developed. Carbon and flax, woven structures, compounded polymers for additive manufacturing and LFT pellets to name a few, will offer new possibilities

- Manufacturing – this may possibly be the pinch-point to the success of thermoplastic composites. In the UK there is a shortage of ‘Tier’ suppliers and globally the automotive supply chain will need to adapt and invest in capital equipment such as presses, heaters, extruders and finishing equipment.

- Diversification – we have discussed primarily the automotive sector in this article but clearly sports, mass transportation, construction and consumer goods can and will benefit from thermoplastic composite technology. Seats, chassis, drums, blades and much more can utilise thermoplastic composites.

- Recyclability/End of Life – as opposed to thermosets there are more recycling opportunities for thermoplastic-based composites as they can be re-ground and re-used. Realistically the resultant intermediate material is likely to be sub-optimal but nonetheless useful.

We hope this brief tour through some of the opportunities presented to every part of the composites supply chain will encourage further investigation of thermoplastic composite products. At we see this as a key area of development and have built up significant knowledge and pilot-scale production equipment with which to commercialise our unique materials and processes. Feel free to contact us to discuss your ideas.

Share this article

Found this article useful? We have a full range of services to help you...

Materials & Process Development

Whether it's thermosetting or thermoplastic composites, biocomposites or nanocomposites, we can help you develop a material or process that meets your requirements.

Developing composites...

Pilot-Scale Manufacturing & Prototyping

Our suite of pilot-scale manufacturing facilities are at your disposal - prepregging, compression moulding, resin transfer moulding, injection moulding, and many more.

Making composites...About the author